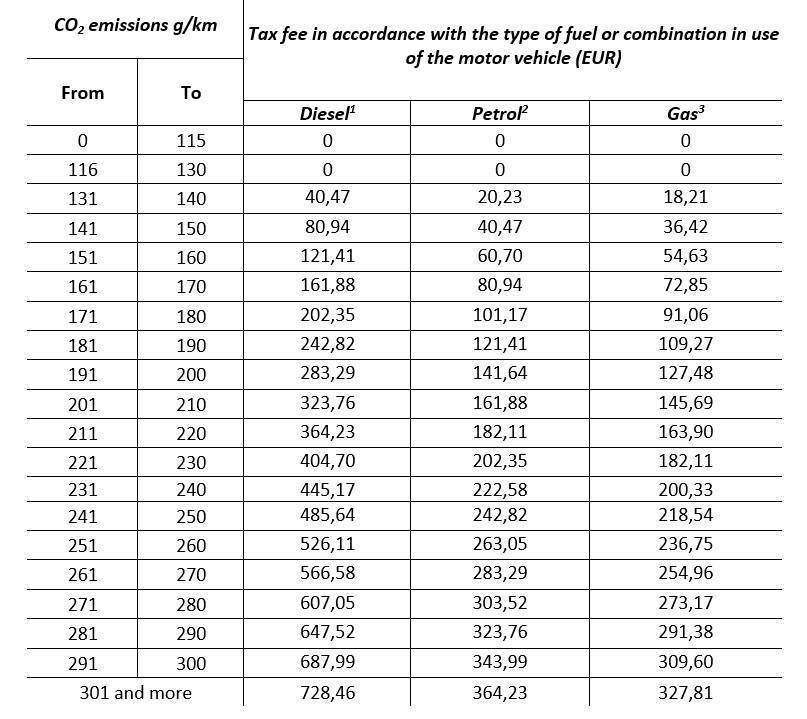

From 01 July 2020, a registration tax fee shall be applicable for the registration of passenger vehicles and light commercial vehicles (M1 and N1 categories) dependent on the type or combination of fuel in use of the vehicle and for cases where the CO2 emissions exceed the 130 g/km threshold.

The tax fee shall be applicable in the following cases:

*The temporary registration period is listed within item H of the Temporary Registration Certificate. Please apply for the registration services prior to the end of the validity period of the registration.

The tax fee shall be excluded in the following cases:

NOTE. The tax fee for the registration of a new motor vehicle may be reimbursed, provided the aforementioned motor vehicle has been deregistered and exported outside the territory of the Republic of Lithuania within 90 days following the date of the new registration (see section Reimbursement of the tax fee).

Tax fee shall apply only in cases where the amount of emissions exceed the 130g/km threshold.

The CO2 emissions may be measured as follows (in the below listed order of priority):

1. By the CO2 emissions specified within the following documents of the motor vehicle:

2. In cases where the CO2 emission data is absent from the aforementioned documents, the CO2 emissions may be measured based on the CO2 emissions of another registered motor car of equivalent type (calculated as median).

Necessary data:

NOTE. The aforementioned information is specified within the appropriate documentation of the motor vehicle (see section Necessary documentation).

3. In cases where the CO2 emissions are not possible to be measured based on the CO2 emissions of another registered motor vehicle of equivalent type, CO2 emissions shall be subject to calculation methods and use of formulas established within the applicable laws.

Necessary data for the calculation specified within the Documents of Origin or Documents for approval:

NOTE. Data subject to calculation shall be dependent on the type of the fuel or combination in use of the motor vehicle.

4. In cases where the CO2 emissions are not possible to be measured by inserting and calculating the technical data of the motor vehicle using the calculation methods and formulas established within the applicable laws, technical data of a motor vehicle of equivalent type shall be used (calculated as median).

Necessary data:

NOTE. The aforementioned information is specified within the appropriate documentation of the motor vehicle (see section Necessary documentation).

1The specified tax fee within the present item shall apply to diesel, diesel/gas, diesel/electrical motor vehicles.

2The specified tax fee within the present item shall apply to gasoline, gasoline/electrical motor vehicles.

3The specified tax fee within the present item shall apply to gasoline/gas, gasoline/ethanol, gasoline/electrical/gas, gasoline/ethanol/gas, gas/electrical, ethanol, ethanol/gas motor vehicles.

You can calculate the preliminary registration tax fee to be paid by use of the Tax calculator.

The exact amount of tax fee to be paid shall be specified during the actual registration of the motor vehicle.

NOTE. Measuring of CO2 emissions using the data from a previously registered motor vehicle of equivalent type is only allowed during the registration of the motor vehicle at the appropriate subdivision of "Regitra".

The tax fee shall be paid during the registration of the motor vehicle as follows:

The motor vehicle registration shall only be completed upon the successful payment of the tax fee.

Registration tax fee may be reimbursed in cases where a new motor vehicle has been deregistered and exported outside the territory of the Republic of Lithuania within 90 days following the initial registration.

Please apply to the appropriate subdivisions of "Regitra" for the reimbursement of the tax fee.

In order to reimburse the tax fee:

The request for the reimbursement of the tax fee shall be examined within 20 business days and the reimbursed fee shall be deposited to the bank account specified within the aforementioned request.